HEALTH

The Health Care Crisis

Wednesday, December 3, 2008

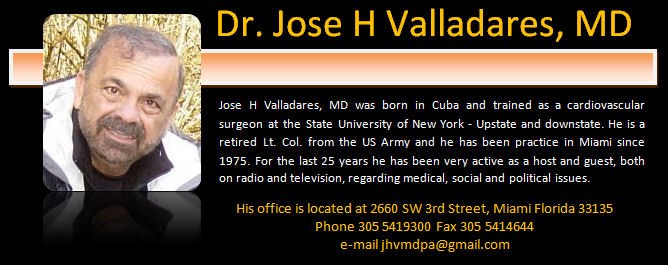

Jose H. Valladares, MD

There is a terrible weirdness to Washington these days. The keys to the Treasury have fallen into corrupt hands and key members of the political class seem intent on getting as much cash out to their friends before the game comes crashing down to a halt. We all know it is dishonest; we all know it is profoundly corrupt. No one can stop it. Fear is used to justify complete nonsense. The banks are failing, the insurance sector is failing, the investment banks are infected with a strange disease; clouds of invisible derivatives are festering in the polluted skies of New York. Run, panic, hide. The sky is falling.

Only it isn't. The remnants of our democracy are being looted. The bill for what has already been taken is so large the next generation will never be able to repay it. If Obama stands for the change we need then he needs to step up to the plate.

The public markets in this country, once the greatest free market concept put into practice, a system that has allowed though the years the greatest ideas and most motivated entrepreneurs access to capitol while allowing the average citizen the opportunity to participate in the process now seems to be completely broken. No longer are ideas that are good for the country and the world funded by responsible well-meaning citizens. Instead today the stock markets now largest casinos in the world overreact manipulate and act as the second largest taxing agency in the country. And now the largest taxing agency in our country the Federal Government is going to step in and help fund the party.

For the right to PLAY with the public’s money the management teams of public companies, which in my opinion have no resemblance to private sector, should be held as financially accountable for the decisions they make as their private sector counterparts. Too much of the compensation for the corner office is guaranteed and determined by an elite group of inbreeds a concept that should roil true free market capitalists. The variable portion of this compensation is also too often tied to short-term measures that are too easily manipulated to once again benefit the smallest group of elitists that play with other people’s money in the stock market, as opposed to long-term fundamentals that position our nation’s largest companies with the ability to compete in a global marketplace. These public entities have made years and years of irresponsible decisions for personal gain and backslapping because those decisions have not directly impacted their own pocketbooks’ as they would have if they were truly private companies.

At least in the current economic conditions. What are the costs to our economic system of liquidation? Would costs be lower if Congress provided funds for a restructuring to occur? These are the questions.

The Bush administration is opposed to a government role in restructuring. Period. Bush would prefer to accept the least optimal potential economic outcome for ideological reasons.

The Democrats want a restructuring process instead of sending a 'bridge loan to nowhere'.

Arguments are being made based on emotional reactions to unions, government intervention in markets and pressure from wealthy special interests to rescue themselves from their management failures

The criminal executives that run these companies need to be fired and imprisoned. Every single cent of their wealth and assets seized. Make no mistake they are criminals who have stolen from their employers, their employees, their investors and from Uncle Sam. Greed, arrogance, immorality, unethical closed door deals and shear stupidity have ruled Detroit for 20 years. Lawyers, HR managers, bean counters and ex-cons run manufacturing, particularly automotive and automotive suppliers. Honest, hard working, moral, intelligent men and women have been run out of the automotive sector. They do not like working with Jackals.

It is going to get real bad. And the people that actually wipe their own ass are going to be the people that suffer the most. The bums and permanent underclass will know no different (they'll just get some more free cheese) and the criminals in the banks and New York will just count their stacks of cash from their yachts.

What is happening with health care?

FIRST

Going back to October 2, 1942, a vote was placed on the so-called “stabilization act” of 1942. Big companies wanted to offer some attraction to a work force shrunk by war mobilization. This bill allowed employers to deduct from taxable income all payments for employee health premiums.

But it did not allow the same benefit if the employee paid. It was at this moment that the workers lost management of their families health care and the employer without a day of training became their doctor.

SECOND

April 10, 1965 LBJ signed into law a bill to provide healthcare benefits for anyone who had passed his or her 65th birthday.

Medicare was created. On this day the federal government without schooling awarded itself an MD degree. As a result of these two issues, individual patients lost control over their medical care and all control over the costs.

Today healthcare is enormously expensive, more so than in any nation. In total $2.2 Trillion a year. The physician is overburdened with paperwork, has hired new employees to fill out forms and arrange referral trails, and with declining pay, has gradually surrendered autonomy and is even now in the process of signing on as an employee with a big clinic or medical center. Payers demand elaborate records, and some physicians say they feel as if they are having to diagram sentences. The practitioner is told that electronic medical records are the magic answer, so he is struggling to learn to type. But one fourth of regional electronic programs have gone out of business and the rest are floundering some hospitals have abandoned their computerized record systems; and only 20% of doctors actually use such programs.

Patients complain that the physician is treating not them but the computer, since eye contact has evaporated. Shrinking compensation has provoked either early retirement or doubling the daily patient load, necessarily resulting in a halving of doctor-patient interaction time. Return phone calls are an anachronism. Primary-care trainees are declining just as the demand is climbing, and the smaller number is more and more made up of international medical graduates. More pressing is the contraction of physician hours, as primary care doctors turn hospital duties over to hospitalists and as two doctors now do the work of one.

Indeed, as a result of key legislative errors, $2 Trillion dollars are being pumped into US healthcare every year without the supervision of the people who earned it, temporarily owned it, and should have controlled it. Our healthcare is getting more expensive and less accessible.

PPOs and HMOs and physician-insurance company contracts began the amateur rationing phase. There was no more balance billing. In fact, the doctor had to promise the payer that he would accept whatever they paid. In the case of Medicare, balance billing was illegal. In the case of insurance companies, it would violate the contract.

The payers managed the revenue and soon they controlled what they would pay for. They would say that the patient did not need a colonoscopy, a PSA or high-priced antibiotic. They were also controlling the diagnosis and the treatment. The clerical personnel had become the patient’s doctor. The health insurance cartel devised multiple rationing methods such as: precertification, denial of benefits, increase of uncovered procedures and other strict measures such as “inadequate documentation.” The health plans had taken a heart and ate the government.

Drug dealers and other illegal operators are always looking for ways to dignify their ill-gotten gains in many ways with what is called “money laundering.” $2.2 Trillion had to be laundered through the system each year. This had to be done before the patient or the doctor received any kind of compensation. It became clear that in order to remain and or enter this new world of reimbursement, 8 minutes visits live with documentation had to be performed. This could only be done by avoiding the really sick and time-demanding patients. The new name for these physicians became the provider or health supplier. The rules to survive were easy: twice the patients per day, ½ the time with each, ½ the value.

The politicians, such as Hillary Clinton, going back to the 1990s, made speeches stating that the patients should choose their own doctor, doctors should run health care, insurance companies should not be telling doctors what to do. They problem was that her 1400 page proposal was offering precisely the reverse. It was in essence the coming of universal healthcare.

The policy scholars assigned to observe and design the new changes have always been spectators from their seats in a stadium. They have never been on the floor of the arena where the gladiators are. Round tables on health care issues, for example, contained among its 20 members, one practicing physician, and no documented patients. Their final report described health care in America as panoply of misuse, overuse, and underuse and recommended a massive unspecified renovation. Another self-appointed arbiter of what should be done in medicine, “the commonwealth fund,” contains 19 members, of which some are MDs, some PhDs -but none of the MDs are treating physicians. The bipartisan committee of the future of healthcare assembled at request of the White House to report to Congress contained 17 people out of which only one was a physician and a non-practitioner. What has really happened is that politicians appoint people with impressive titles to help arrange policy forgetting that the activity to be governed is just as strange to the appointees as to the appointers. The average practicing physician with a skyrocketing overhead, plummeting reimbursement by third party payers, cannot afford to leave his post to sit on an all-day committee unless he is supported from other sources.

What about other systems in other countries? A report from the CATO institute tells us “the grass is not always greener.” Unified health systems of 12 developed countries were studied concluding that 1. They are all different 2. Not that universal and 3. Not that wonderful.

For example, Canada, the system that is most often touted by planners, has a health plan that has faded precipitously in the last decade. Tests such as PSA (a blood test to determine prostate cancer) are done half as often as in the USA. The same for PAP smears (cytology of female genitalia) and mammograms are done 1/3 as often as in the USA. Not surprisingly, deaths from prostate CA are 18% and breast CA 25% higher than in the USA. The average time to see an orthopedic surgeon and get on the operating schedule is around 40 weeks. People with angina are only 1/3 likely to get angioplasty, catheterized or bypassed. Canadian health costs will consume ½ of the gross domestic product by 2050.

The UK: If you need a hernia operation, you will join the 1 million Britons out of the 60 million in the population waiting for a hospital bed. 1/3 of them wait over 30 weeks. Once you get to be 64 years of age and over, you become a victim of HISM –the national health service has decried that no preventive screening tests for cancer should be done over 65 despite the fact that this when cancers become more frequent. Death rates from pneumonia in that age group a triple compared to the USA.

France: You pay 18.8% from your payroll taxes in addition to alcohol and tobacco taxes. It is interesting to know that 92% of the citizens pay for private insurance in addition to 30% co-pays. In Paris, 80% of the doctors bill additionally. In there you pay up front and later collect from the government or the insurance company.

Even though in the USA Medicaid patients receive terribly fragmented care and the Medicare patients, as well as the doctors, are bound by very elaborate rules that make it very difficult to practice medicine, we continue to say the free enterprise has not worked and thus we have to go to a single payer system. The reality is that patients assigned benefits to the insurance company or Medicare and the insurers pays the provider whether it is doctor or hospital, prices are now being set by the insurance company and government. We have accidentally done a controlled experiment in which ½ of our healthcare is government sponsored and in the private sector 2/3 of the people are covered by a third party i.e. insurance company. Therefore in reality we have never tested the free enterprise system.

DRUG PRICES

Annually, we spend $230 billion –more than any European nation. Antibiotics range from $10/day and some other drugs, like cancer drugs, may run to $10,000 per year. All other countries have their governments negotiate prices with the pharmaceutical companies. The VA does it. However, when Plan D was implemented (the plan allowing patients to obtain meds at markedly reduced prices) part of the law contained that government would NOT negotiate prices wit the drug companies. In essence, big pharm is making a killing.

It cost about $800 million to put a new drug in the marketplace in the USA. This includes, research, development, production, distribution and marketing. This money has to be recovered or the stock holders will go away. Thus these new drugs cost a lot during the early years while on patent.

We are about the only country that invents new drugs. Other countries use ours.

When drugs go off patent, they become generic and less expensive. They cost less in the USA than anywhere else the reason being that the government does not set the price and competition is allowed.

The major players in the drug business, which are essentially the same companies running managed care, have progressed into a basically unaffordable system by creating subterfuges such as approved drugs under formularies.

Basically what happens is that one of the plans covers all of the medications that a beneficiary may need leaving him on his own to pay whatever price is demanded in the outside market.

The approved medication formularies change a regular basis meaning they keep you guessing which is drug that is at present covered.

MEDICAL MALPRACTICE

• Medical diagnostic, procedural and treatment of patients are a complex biological and technical service where each individual is a different case, even if having the same condition as other. Of course, errors can occur.

• Victims of injuries can never be properly compensated for said errors.

• A pretense that they can be compensated has been created through litigation that becomes a horrifying experience trying to place value on human life, adding, multiplying, subtracting, dividing, and extrapolating hypothetical expectations, when in reality they are based on available money to be paid to the plaintiff and its lawyer.

• There are more than 125,000 frivolous, meritless cases in progress every day at a cost of a minimum of $30,000 each.

• The cost of tort has risen by a factor of 400 between 1940 and 1990. Typical payouts average: 24% for economic cost to the victim; 22% for pain and suffering; 24% for administration of the case, 16% for claimant's attorneys' fees; and 14% for other defense costs.

• The cost of medical defense is between $50 to $90 billion each year.

• The only result has been the closure of clinics, the driving away of physicians from their practices and the jeopardizing of patient proper care, while driving up costs. One third of the cost of a pacemaker or a third of the cost of a simple tonsillectomy goes to liability protection. In Nevada, women have to deliver babies in the Emergency Room or go to another State, because the OB/GYN liability policies have scared away specialists.

• A recent fanfare over medical practice is in essence a well thought plan to deviate attention from the real problems, stated above, and for all practical reasons, create a "medical malpractice hoax".

The insurance companies claim they must raise their premiums because of doctors' errors and juries ever increasing awards to victims. And they threaten with bankruptcy or leaving a State as a way to pressure States' legislatures to award higher rates, but as a group they are practically unsupervised and very lightly regulated.

Doctors, on the other hand, are the most regulated group of professionals in modem history. The following is an incomplete list of parties that watch over physicians:

• State Medical Boards

• Department of Health and Human Resources

• The Office of the Inspector General

• The Clinical Laboratory Improvement Act

• The American Disabilities Act

• Peer Review Boards

• Individual Hospital Boards

• Workplace laws

• Drug and Prescription laws

• HMOs

• Anti- Trust laws

• Stark II

• Third party payers

• And of course, predatory actions of Malpractice Lawyers

Nevertheless, the burden of increasing cost of premiums fall upon doctors who can not raise their prices to pass this cost to patients since the health plans will not allow it.

Medical advances and an increasing aging population have escalated costs. US medical care (if you can get to it) is the best in the world, and also the most expensive. Thus, "Health" has become a TRILLION dollar industry. This is a really big pie. And all big pies attract modem predators.

The government heralded managed care in the middle 80's as the solution to contain the ever increasing costs ... including more regulation for the doctors. Ten years later it was evident that the reverse was happening. Enrollment in the managed care companies dropped and merchants fled the market unable to obtaining juicy profits in spite of not having legal accountability for their rationing of medical care. Health costs had not been contained, stocks were tumbling, and patients and physicians were demanding that the "shackles" of managed care were removed.

Between 1995 and 1999, when most wages in the nation were rising an average of 3% rapidly, the average physician income, adjusted for inflation, decreased by 5%.

Today we have over 60 million people without health insurance, out of a 300 million population -and a real medical crisis.

The lack of insurance coverage, placing limits in hospital stays, emergency room usage, procedures options and specialists' care in order to maintain benefits and increase profits, the management care and insurance companies have created a climate of diminishing quality and quantity of the health care, which in turn encourages litigation.

It is clear that the "malpractice crisis" is the end result of the inability of the insurance companies to yield a profit using non-substantiated data, catalyzed by the legal system, while using the Government as a shield.

The interested parties wish to continue enjoying the "big pie", although the doctors are reluctant to continue being an involuntary part of the hoax. So the issue has been brought to many State legislatures, such as Florida, with the intention that legislators, as "sorcerers" can produce a miracle by finding "workable" solutions to allow the show to goon.

Items such as "pain and suffering", "bad faith", and "caps" attempting to create a ''No Fault Auto" look-alike have been brought into play, all with the intention of limiting the payments to be made by the insurance industry ... while no mention has been made to prices, premiums, and proper regulation of insurers. A mandatory mention every once in a while of a "Universal Health Coverage" is an integral part of this made-to-order crisis, being brewed while we are diverted with other topics.

The Universal Health Coverage option is based on the principle that in order for things to remain the same we must change everything. This disguised managed care alternative has been proven not to be able to contain costs even by withholding benefits or life saving care, while at the same time mortally wounding the scientific research which has kept the United States first in the world in the advancement of health care.

When you study the problem in its proper perspective, taking the four players in consideration, that is: patients, doctors, insurers and lawyers, it is evident that the root of the problem arises from an improper "health insurance system" (which historically and ironically was already mandated by Otto Von Bismarck in the 19th Century).

How does malpractice fit in this? As already mentioned, in an inefficient health care system, which attempts to depend on managed care's ever reducing proper care in search of profits, the care deteriorates and litigation increases.

My conclusion is:

• There are 60 million people, in a 300 million population, without health insurance coverage.

• Article 25 of the Declaration of Human Rights reads that each person and his/her family has a right to health care, food and housing, but it is ignored.

• Doctors are bound by law to do the right thing for patients, to protect them and inform them of choices, alternatives and risks.

• Meanwhile, profit seeking managed care continues to make multimillionaires of venture investors, by compromising proper care, leaving doctors with moral, legal and financial residuals.

• Improper care is created by the displacement of drug coverage, non-coverage of medically necessary items, and delayed referral to overworked specialists, as the tools for "rationing" due care.

The House Judiciary Committee has met to discuss Medical Malpractice Reform and has reviewed physicians' income tax, credit, patient injury compensation funds, "professional discipline of physicians", physicians' homestead exemptions, non economic cap of $250,000, elimination of several liabilities, disclosure of collateral resources, periodic payments of awards, limits on trauma liabilities, etc, etc, etc ... practically everything ...except the only issue that would solve the problem. That of properly regulating care management and insurance companies -the birthplace of the so called crisis.

The malpractice issue must be addressed, but not with a search for a "miracle' by busy legislators or by political appointees ... or by disguised interested parties. Most 'miracles' produced by this type of solution seekers are of the kind we hear often ... a "roll back" in premiums ... a 20% reduction of premiums ... all about premiums that can not be afforded anyway.

No proper solution will be found unless those that are really in the battle front are taken in consideration. Malpractice exists because of inadequate health coverage. Place the responsibility where it belongs, in the health insurance and managed care concerns, and malpractice will no longer be a problem.

Note: Dollar figures quoted are from the beginning of the last decade and therefore have substantially increased.

BEST POSSIBLE SOLUTIONS

In 2004, the Bush Administration authorized health savings accounts (HSA).

Under this plan, the individual first obtains a high deductible insurance (Catastrophic policy) to cover major medical problems. Then he can set aside an annual fund –pre tax –for ongoing medical expenses. Major events such as heart attack or surgery will be covered after the very large deductible. At that point the catastrophic policy goes into effect and covers the expenses. Week to week medical expenses can be paid directly out of the fund.

There are approximately 6.2 million HSA accounts in the USA.

HSAs may come from the employer, employee, a combination or can originate from the individual. It is permanent, roles over from year to year, is tax deductible for both employer and employee and can become part of the retirement account.

In order for HSAs to work, a high deductible or catastrophic program has to be in effect. The average American citizen spent approximately $7000/year in 2008.

Patients under 65 spend an average of $4500 per year. The average Medicare patient spends approximately $15K per year. Medicare may be combined with an HSA account.

Medicaid

The Medicaid patient is given a voucher containing a major medical provision and a cost defined fund which can be presented to any approved health provider who can then withdraw payments on a predetermined price list.

There are approximately 60 million patients at a cost of approximately $5200 per year.

HSA for uninsured patients who pay no taxes.

The uninsured patient, whether indigent or not, usually presents to the ER, receives care and does not pay. The bill is usually not successfully pursued by the provider. The amount is unknown but thought to be enormous. In 2006 it was estimated at $31 billion.

Consumers with HSA funds or vouchers cannot use money to purchase health insurance.

Health insurance should be purchasable across state lines. The average premium in New Jersey is 5 times that of Nevada. This is because of mandates where various merchants have persuaded the legislature to include payments for massage, aroma therapy, yoga etc.

THE FUTURE

The lawmakers in Capitol Hill are afraid to touch or remove or change any benefits for they do not wish to anger their big corporate supporters who have a vested interest in the status quo (insurance, big pharm). They also dread to mention raising taxes. The usual pattern has been that nothing happens. The newly elected President opposes individual plans but favors massive government expenditures to provide coverage for everyone despite the facts that Medicare and Medicaid are both doing a poor job and face bankruptcy. We all need to be informed of what is actually happening in our nation which has progressed to indolence, apathy, acceptance and dependency. We now ignore our right to health care -a basic human right.

FURTHER READING

1. Medicaid Spending Surges in 2007.

www.heartland.org/policybot/results.html?articleid=21128

2. Karkaria, U. Study: State Medicaid reform pilot falls short. www.jacksonville.com/tu-online/stories/050907/bus_168514889.shtml. May 9, 2007

3. NY Times Editorial Medicare’s Bias. www.nytimes.com/2008/07/14/opinion/14mon1.html

4. Reed, Jack. A Plan to benefit HMOs, not seniors. The Miami Herald. Other Views, Saturday, December 6, 2003.

5. Moffit, R. The President’s Medicare Budget Proposal: A Step Forward on Entitlement Spending. www.heritage.org. February 6, 2007.

6. Pugh, T. Health funding worse off than Social Security. The Miami Herald, Monday, January 17, 2005.

7. Stecklow, Steve and Furhmans, Vanessa. UnitedHealth Executives Forfeit $390 Million in Options. The New York Times. Market Place, Thursday, November 9, 2006.

8. Dorschner, John. Government plans boost HMOs. The Miami Herald. Business, Friday, Januray 23, 2004.

9. Dorschner, John. Florida HMOs post large profits. The Miami Herald. Business, Thursday, May 25, 2006.

10. NY hospitals sue UnitedHealth, claim racketeering. www.fiercehealthcare.com February 7, 2007

11. Physicians’ suit against UnitedHealth dismissed. www.aapsonline.org. June 22, 2006.

12. UnitedHealth Group ex-CEO forfeits $620 million. www.aaps.com News of the Day, January 2, 2008.

13. Appleby, Julie. Tenet accused of $1 billion Medicare Fraud. www.usatody.com March 3, 2005.

14. Loyd, Linda. Tenet will pay $7M to settle Medicare overcharging lawsuit. The Philadelphia Inquirer. February 21, 2006.

15. Tenet Pays $900 Million to Settle Medicare Fraud Claims. White Collar Crime Prof Blog. www.lawprofessors.typepad.com. June 30, 2006.

16. Tenet wins $1B federal lawsuit over outlier payments. www.fiercehealthcare.com August 6, 2007.

17. Morse, D. and Terhune, C. HealthSouth’s Scrushy is Acquitted. The Wall Street Journal. Wednesday, June 29, 2005.

18. Trojan, N. Forum on Scrushy. www.gotroytrojans.com/forums

19. Dorschner, J. Blue Cross to pay Doctors. www.miamihearld.com. April, 19, 2008

20. Blue Cross and Blue Shield to pay $128million in settlement. www.miamiherald.com April 27, 2007

21. Dorschner, J. Insurer settles with $128M cash payment. www.miamiherald.com April 28, 2007.

22. Gov. Romney signs Massachusetts universal coverage bill; vetoes employer “fair share contribution” www.aaps.com News of the Day, April 15, 2006.

23. Moffit, R. Magical Thinking. www.aapsonline.org. Volume 62, No. 5, May 2006.

24. WellCare to pay $32.5M settlement. www.fiercehealthcare.com August 25, 2008

25. Waters III, W. Two Days that Ruined Your Health Care (And How you can Provide the Cure). Logikon Press, Newnan, Georgia, September 1, 2008.

What the Pelosi Health Care Bill Really Says

WSJ November 6, 2009

Here are some important passages in the 2,000 page legislation.

By BETSY MCCAUGHEY

The health bill that House Speaker Nancy Pelosi is bringing to a vote (H.R. 3962) is 1,990 pages. Here are some of the details you need to know.

What the government will require you to do:

• Sec. 202 (p. 91-92) of the bill requires you to enroll in a "qualified plan." If you get your insurance at work, your employer will have a "grace period" to switch you to a "qualified plan," meaning a plan designed by the Secretary of Health and Human Services. If you buy your own insurance, there's no grace period. You'll have to enroll in a qualified plan as soon as any term in your contract changes, such as the co-pay, deductible or benefit.

• Sec. 224 (p. 118) provides that 18 months after the bill becomes law, the Secretary of Health and Human Services will decide what a "qualified plan" covers and how much you'll be legally required to pay for it. That's like a banker telling you to sign the loan agreement now, then filling in the interest rate and repayment terms 18 months later.

Protestors wave signs in front of the Capitol on Thursday.

On Nov. 2, the Congressional Budget Office estimated what the plans will likely cost. An individual earning $44,000 before taxes who purchases his own insurance will have to pay a $5,300 premium and an estimated $2,000 in out-of-pocket expenses, for a total of $7,300 a year, which is 17% of his pre-tax income. A family earning $102,100 a year before taxes will have to pay a $15,000 premium plus an estimated $5,300 out-of-pocket, for a $20,300 total, or 20% of its pre-tax income. Individuals and families earning less than these amounts will be eligible for subsidies paid directly to their insurer.

• Sec. 303 (pp. 167-168) makes it clear that, although the "qualified plan" is not yet designed, it will be of the "one size fits all" variety. The bill claims to offer choice—basic, enhanced and premium levels—but the benefits are the same. Only the co-pays and deductibles differ. You will have to enroll in the same plan, whether the government is paying for it or you and your employer are footing the bill.

• Sec. 59b (pp. 297-299) says that when you file your taxes, you must include proof that you are in a qualified plan. If not, you will be fined thousands of dollars. Illegal immigrants are exempt from this requirement.

• Sec. 412 (p. 272) says that employers must provide a "qualified plan" for their employees and pay 72.5% of the cost, and a smaller share of family coverage, or incur an 8% payroll tax. Small businesses, with payrolls from $500,000 to $750,000, are fined less.

Eviscerating Medicare:

In addition to reducing future Medicare funding by an estimated $500 billion, the bill fundamentally changes how Medicare pays doctors and hospitals, permitting the government to dictate treatment decisions.

• Sec. 1302 (pp. 672-692) moves Medicare from a fee-for-service payment system, in which patients choose which doctors to see and doctors are paid for each service they provide, toward what's called a "medical home."

The medical home is this decade's version of HMO-restrictions on care. A primary-care provider manages access to costly specialists and diagnostic tests for a flat monthly fee. The bill specifies that patients may have to settle for a nurse practitioner rather than a physician as the primary-care provider. Medical homes begin with demonstration projects, but the HHS secretary is authorized to "disseminate this approach rapidly on a national basis."

A December 2008 Congressional Budget Office report noted that "medical homes" were likely to resemble the unpopular gatekeepers of 20 years ago if cost control was a priority.

• Sec. 1114 (pp. 391-393) replaces physicians with physician assistants in overseeing care for hospice patients.

• Secs. 1158-1160 (pp. 499-520) initiates programs to reduce payments for patient care to what it costs in the lowest cost regions of the country. This will reduce payments for care (and by implication the standard of care) for hospital patients in higher cost areas such as New York and Florida.

• Sec. 1161 (pp. 520-545) cuts payments to Medicare Advantage plans (used by 20% of seniors). Advantage plans have warned this will result in reductions in optional benefits such as vision and dental care.

• Sec. 1402 (p. 756) says that the results of comparative effectiveness research conducted by the government will be delivered to doctors electronically to guide their use of "medical items and services."

Questionable Priorities:

While the bill will slash Medicare funding, it will also direct billions of dollars to numerous inner-city social work and diversity programs with vague standards of accountability.

• Sec. 399V (p. 1422) provides for grants to community "entities" with no required qualifications except having "documented community activity and experience with community healthcare workers" to "educate, guide, and provide experiential learning opportunities" aimed at drug abuse, poor nutrition, smoking and obesity. "Each community health worker program receiving funds under the grant will provide services in the cultural context most appropriate for the individual served by the program."

These programs will "enhance the capacity of individuals to utilize health services and health related social services under Federal, State and local programs by assisting individuals in establishing eligibility . . . and in receiving services and other benefits" including transportation and translation services.

• Sec. 222 (p. 617) provides reimbursement for culturally and linguistically appropriate services. This program will train health-care workers to inform Medicare beneficiaries of their "right" to have an interpreter at all times and with no co-pays for language services.

• Secs. 2521 and 2533 (pp. 1379 and 1437) establishes racial and ethnic preferences in awarding grants for training nurses and creating secondary-school health science programs. For example, grants for nursing schools should "give preference to programs that provide for improving the diversity of new nurse graduates to reflect changes in the demographics of the patient population." And secondary-school grants should go to schools "graduating students from disadvantaged backgrounds including racial and ethnic minorities."

• Sec. 305 (p. 189) Provides for automatic Medicaid enrollment of newborns who do not otherwise have insurance.

For the text of the bill with page numbers, see www.defendyourhealthcare.us.

Ms. McCaughey is chairman of the Committee to Reduce Infection Deaths and a former Lt. Governor of New York state.

Copyright 2009 Dow Jones & Company, Inc. All Rights Reserved

This copy is for your personal, non-commercial use only. Distribution and use of this material are governed by our Subscriber Agreement and by copyright law. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at 1-800-843-0008 or visit

HEALTHCARE REFORM

JULY 2009

The Obama administration's plans for healthcare reform could mean relief for almost 50 million uninsured Americans.

This newly covered healthier work force will be less likely to call in sick as in theory they would have access to health care in an outpatient setting. Emergency rooms would be significantly less clogged with people who can't afford primary care as they would now be insured and could go see a primary care physician.

This new health care reform is based in part on providing competition by using the Government as another insurance source thus bringing down the price and improving quality.

IF THE NEW HEALTH CARE REFORM PASSES IT WILL ALSO INCLUDE CHANGES SIMILAR TO WHAT EXISITS IN THE UK WHERE A BOARD CAN ACCEPT OR REJECT TREATMENTS BASED ON THE NUMBER OF YEARS THAT A PATIENT MAY BENEFIT FROM TREATMENT.

THIS ACTUALLY AMOUNTS TO DISCRIMINATION IN THE ELDERLY WHOSE LIFE EXPECTANCY IS BY DEFINITION SHORTER THAN A YOUNGER INDIVIDUAL.

IT COULD ALSO BE INTERPRETED AS A COVERT FORM OF EUTHANASIA BY REGULATING POTENTIALLY EXPENSIVE CARE SUCH AS THAT RECEIVED WHEN ADMITTED INTO AN INTENSIVE CARE UNIT. IT WOULD MODIFY HOSPICE COVERAGE WITH THE CONSEQUENCE OF DEATH BEING ENCOURAGED AT HOME. IN THEORY THIS SOUNDS VERY NICE; HOWEVER FROM A PRACTICAL STANDPOINT THE IS QUESTION OF WHO AND WHAT KIND OF ASSISTANCE IS GOING TO BE PROVIDED TO THESE INDIVIDUALS.

At the presents four (4) states have legalized euthanasia: Oregon, Washington, California and Michigan. Surely this number is inclined to grow in the future.

Listen to audio by Betsy McCaughey, former NY lieutenant Governor and now on the Committee to Reduce Infectious Deaths commenting on new House Bill for Health Care reform. Very Impacting and worthwhile the 8 minutes it takes to listen.

http://fredthompsonshow.com/premiumstream?dispid=320&headerDest=L3BnL2pzcC9tZWRpYS9mbGFzaHdlbGNvbWUuanNwP3BpZD03MzUxJnBsYXlsaXN0PXRydWUmY2hhcnR0eXBlPWNoYXJ0JmNoYXJ0SUQ9MzIwJnBsYXlsaXN0U2l6ZT01

If lawmakers can reach an accord one thing is nearly certain: for the first time in history every American would be required to carry health insurance. Just as automobiles drivers are required to obtain insurance, the medical system of the future will place responsibility for health care coverage first and foremost on everyone.

Many of the nation’s 50 million uninsured people would be required to purchase a healthy policy or face financial penalties. Waivers and discounts however would be provided for lower income Americas in order to make it more affordable for them.

The government’s idea is that without an individual mandate universal coverage cannot be achieved.

This obviously places an unfair financial burden on lower income consumers and would force individuals into an overpriced underperforming health care system.

At this point hospitals, insurers and drug companies are salivating at the prospect of up to 50 million newly insured customers and are lobbying ferociously for this Federal provision. 1/3 of those uninsured in the US are between the ages of 19-29. 42% are between 30-54. This is based on the fact that young, healthy workers choose not to purchase insurance believing that they do not need it. The average cost nationwide of health insurance purchased through an employer is $12,680 per year for a family plan and $4,700 for an individual plan.

Fraud is and continues to be a huge issue with the government. However, the existing fraud is largely and mainly due to incompetence, lack of oversight and quid pro quo for those issuing licenses and billing numbers for Medicare and Medicaid.

There must be a higher degree of accountability and responsibility for those issuing licenses and billing numbers. Although these agencies cannot predict what if any illegal or unscrupulous actions or behaviors may transpire, they may however establish a protocol looking at those applying with a higher degree of scrutiny.

FACTS

Medicaid is run and financed in combination with the states to provide health care to about 60 million poor people.

Medicare provides health coverage to about 45 million people. It is less expensive to administer through the government than through private plans (HMOs).

According to the government figures while Medicare spends only 2-3% on administrative expenses, large private insurers (HMOs) may spend upwards of 17%.

WHAT IS HAPPENING NOW

Democratic legislators that form part of a committee for Health, education and pensions have a project that will offer health care to 21 million of the 50 million uninsured people. The program is called HELP and will cost $611 billion.

SAMPLING OF MEDICARE COSTS BY CITY

SAMPLING OF MEDICARE COSTS BY CITYFIGURES ARE FOR 2006

*DARTMOUTH RESEARCHERS MEASURING MEDICARE EXPENDITURES. TAKEN FROM MIAMI HERALD ARTICLE Medicine: South Florida’s Money Tree, Sunday, June 28, 2009;

The above figures were presented in an article regarding expenditures with no statistical analyses regarding the conclusions.

HOW HEALTHCARE BILLS COMPARE

Let’s examine some statement being made about the current healthcare system:

South Florida has more doctors referring more patients to more specialists and ordering up more high-tech imaging tests than other areas. As a result, employer-based health insurance is 20% more expensive here. And yet, we're no healthier and we don't live any longer. This is a false statement. If we look at the facts:

The first cause of death in the USA is CARDIOVASCULAR DISEASE. IT HAS DECREASED OF 66% IN THE LAST 50 YEARS

The second cause of death is CANCER. CANCER SURVIVAL RATES are UP 30% IN THE LAST 30 YEARS

The third cause of death is STROKE. DEATH FROM STROKE IS 66% LESS IN THE LAST 50 YEARS.

Click on the link for list on life expectancy by country http://en.wikipedia.org/wiki/List_of_countries_by_life_expectancy.

We acknowledge that the present system is not working and needs to be changed. This is misleading statement. It points towards managed care which is the system that predominates and DOES NOT WORK. It does not work because it rations health care and costs more in terms of unnecessary administrative, bureaucratic and third party expenses. If the present is not working with what already is predominantly in place, to do more of the same would be to obtain the same result.

What's happening here now is not sustainable.

Doctors tell the patient what he or she needs and then provide it, in effect dictating both supply and demand. Since a third party -- a private insurer or Medicare -- pays the bulk of the bill, patients rarely complain.

Supervision does not exist. These are false statements. Why?

Because doctors are the most regulated group of professionals in modern history.

The following is an incomplete list of parties that watch over physicians:

• State Medical Boards

• Department of Health and Human Resources

• The Office of the Inspector General

• The Clinical Laboratory Improvement Act

• The American Disabilities Act

• Peer Review Boards

• Individual Hospital Boards

• Workplace laws

• Drug and Prescription laws

• HMOs

• Anti- Trust laws

• Stark II

• Third party payers

• And of course, predatory actions of Malpractice Lawyers

We spend a lot of money in the USA and in other countries the coverage is better. This is a FALSE statement.

TOTAL EXPENDITURES FOR US IN ANNUAL HEALTH CARE PER CAPITA

• USA $7,026

• FRANCE $4,056

They pay 18.8% from your payroll taxes in addition to alcohol and tobacco taxes. It is interesting to know that 92% of the citizens pay for private insurance in addition to 30% co-pays.

• CANADA $3,912

Canada, the system that is most often touted by planners, has a health plan that has faded precipitously in the last decade. Tests such as PSA (a blood test to determine prostate cancer) are done half as often as in the USA. The same for PAP smears (cytology of female genitalia) and mammograms are done 1/3 as often as in the USA. Not surprisingly, deaths from prostate CA are 18% and breast CA 25% higher than in the USA. The average time to see an orthopedic surgeon and get on the operating schedule is around 40 weeks. People with angina are only 1/3 likely to get angioplasty, catheterized or bypassed. Canadian health costs will consume ½ of the gross domestic product by 2050.

The UK: If you need a hernia operation, you will join the 1 million Britons out of the 60 million in the population waiting for a hospital bed. 1/3 of them wait over 30 weeks. Once you get to be 64 years of age and over, you become a victim of HISM –the national health service has decried that no preventive screening tests for cancer should be done over 65 despite the fact that this when cancers become more frequent. Death rates from pneumonia in that age group a triple compared to the USA.

Well that is obvious. The question is WHAT IS REALLY HAPPENING?

UNEMPLOYMENT is OVER 10% (ACTUALLY THE FIGURES are DOUBLE).

TRILLION DOLLARS IN BAILOUTS HAVE BEEN ARCHITECTED BY THE SAME SPECIES THAT LOOT THE GOVERNMENT AND WANT TO GAIN THE LOOTING CONTROL OF THE TRILLIONAIRE HEALTH CARE INDUSTRY.

CRISIS AFTER CRISIS WITH BALLOON BURSTS

We have seen crisis after crisis and bursting of bubbles where there were promises and assurances made so these problems would not happen in the future. Let’s briefly analyze four of recent crises and extrapolate what happens if the same pitfalls would befall health care reform.

CRISIS-BUBBLE #1 - TECH STOCKS

The average investor didn't know at the time was that the banks had changed the rules of the game, making the deals look better than they actually were. They did this by setting up what was, in reality, a two-tiered investment system - one for the insiders who knew the real numbers, and another for the lay investor who was invited to chase soaring prices the banks themselves knew were irrational. "Since the Depression, there were strict underwriting guidelines that Wall Street adhered to when taking a company public," says one prominent hedge-fund manager. "The company had to be in business for a minimum of five years, and it had to show profitability for three consecutive years. The problem was, nobody told investors that the rules had changed. "Everyone on the inside knew," the manager says.

Such practices conspired to turn the Internet bubble into one of the greatest financial disasters in world history: Some $5 trillion of wealth was wiped out on the NASDAQ alone. But the real problem wasn't the money that was lost by shareholders, it was the money gained by investment bankers, who received hefty bonuses for tampering with the market.

CONCLUSION

The market was no longer a rationally managed place to grow real, profitable businesses: It was a huge ocean of Someone Else's Money where bankers hauled in vast sums through whatever means necessary and tried to convert that money into bonuses and payouts as quickly as possible.

CRISIS-BUBBLE #2 - THE HOUSING CRAZE

They bundled hundreds of different mortgages into instruments called Collateralized Debt Obligations. Then they sold investors on the idea that, because a bunch of those mortgages would turn out to be OK, there was no reason to worry so much about the lovely ones: The CDO, as a whole, was sound. Thus, junk-rated mortgages were turned into AAA-rated investments. Second, to hedge its own bets, Goldman got companies like AIG to provide insurance - known as credit-default swaps - on the CDOs.

CONCLUSION

In 2000, on its last day in session, Congress passed the now-notorious Commodity Futures Modernization Act, which had been inserted into an 11,000-page spending bill at the last minute, with almost no debate on the floor of the Senate. Banks were now free to trade default swaps with impunity.

But the story didn't end there. AIG, a major purveyor of default swaps, approached the New York State Insurance Department in 2000 and asked whether default swaps would be regulated as insurance.

Moreover, 58 percent of the loans included little or no documentation - no names of the borrowers, no addresses of the homes, just zip codes. Yet both of the major ratings agencies, Moody's and Standard & Poor's, rated 93 percent of the issue as investment grade.

CRISIS-BUBBLE #4 – GAS AT $4 A GALLON

By the beginning of 2008, the financial world was in turmoil. Wall Street had spent the past two and a half decades producing one scandal after another, which didn't leave much to sell that wasn't tainted.

With the public reluctant to put money in anything that felt like a paper investment, the Street quietly moved the casino to the physical-commodities market - stuff you could touch: corn, coffee, cocoa, wheat and, above all, energy commodities, especially oil. In conjunction with a decline in the dollar, the credit crunch and the housing crash caused a "flight to commodities." Oil futures in particular skyrocketed, as the price of a single barrel went from around $60 in the middle of 2007 to a high of $147 in the summer of 2008.

But it was all a lie. While the global supply of oil will eventually dry up, the short-term flow has actually been increasing. In the six months before prices spiked, according to the U.S. Energy Information Administration, the world oil supply rose from 85.24 million barrels a day to 85.72 million. Over the same period, world oil demand dropped from 86.82 million barrels a day to 86.07 million. Not only was the short-term supply of oil rising, the demand for it was falling - which, in classic economic terms, should have brought prices at the pump down.

So what caused the huge spike in oil prices Goldman did it by persuading pension funds and other large institutional investors to invest in oil futures - agreeing to buy oil at a certain price on a fixed date. The push transformed oil from a physical commodity, rigidly subject to supply and demand, into something to bet on, like a stock. Between 2003 and 2008, the amount of speculative money in commodities grew from $13 billion to $317 billion, an increase of 2,300 percent. By 2008, a barrel of oil was traded 27 times, on average, before it was actually delivered and consumed.

If that happened, prices would be affected by something other than supply and demand, and price manipulations would ensue. A new law empowered the Commodity Futures Trading Commission - the very same body that would later try and fail to regulate credit swaps - to place limits on speculative trades in commodities. As a result of the CFTC's oversight, peace and harmony reigned in the commodities markets for more than 50 years. All that changed in 1991.

Goldman and other banks were free to drive more investors into the commodities markets, enabling speculators to place increasingly big bets. That 1991 letter from Goldman more or less directly led to the oil bubble in 2008, when the number of speculators in the market - driven there by fear of the falling dollar and the housing crash - finally overwhelmed the real physical suppliers and consumers. By 2008, at least three quarters of the activity on the commodity exchanges was speculative, according to a congressional staffer who studied the numbers - and that's likely a conservative estimate. By the middle of last summer, despite rising supply and a drop in demand, we were paying $4 a gallon every time we pulled up to the pump.

CONCLUSION

By the summer of 2008, in fact, commodities speculators had bought and stockpiled enough oil futures to fill 1.1 billion barrels of crude, which meant that speculators owned more future oil on paper than there was real, physical oil stored in all of the country's commercial storage tanks and the Strategic Petroleum Reserve combined. It was a repeat of both the Internet craze and the housing bubble, when Wall Street jacked up present-day profits by selling suckers shares of a fictional fantasy future of endlessly rising prices.

The oil-commodities melon hit the pavement hard in the summer of 2008, causing a massive loss of wealth; crude prices plunged from $147 to $33. Once again the big losers were ordinary people. The pensioners whose funds invested in this crap got massacred: CalPERS, the California Public Employees' Retirement System, had $1.1 billion in commodities when the crash came. And the damage didn't just come from oil. Soaring food prices driven by the commodities bubble led to catastrophes across the planet, forcing an estimated 100 million people into hunger and sparking food riots throughout the Third World.

CRISIS-BUBBLE #4 - RIGGING THE BAILOUT

After the oil bubble collapsed last fall, there was no new bubble to keep things humming - this time, the money seems to be really gone, like worldwide-depression gone.

It began in September of last year, when then-Treasury secretary Paulson made a momentous series of decisions, Paulson green lighted a massive, $85 billion bailout of AIG, which promptly turned around and repaid $13 billion it owed to Goldman. Thanks to the rescue effort, the bank ended up getting paid in full for its bad bets: By contrast, retired auto workers awaiting the Chrysler bailout will be lucky to receive 50 cents for every dollar they are owed.

Immediately after the AIG bailout, Paulson announced his federal bailout for the financial industry, a $700 billion plan called the Troubled Asset Relief Program, and put a heretofore unknown 35-year-old Goldman banker named Neel Kashkari in charge of administering the funds. In order to qualify for bailout monies, Goldman announced that it would convert from an investment bank to a bank holding company, a move that allows it access not only to $10 billion in TARP funds, but to a whole galaxy of less conspicuous, publicly backed funding - most notably, lending from the discount window of the Federal Reserve.

CONCLUSION

As a result the Feds have guaranteed at least $8.7 trillion under a series of new bailout programs - and thanks to an obscure law allowing the Fed to block most congressional audits, both the amounts and the recipients of the monies remain almost entirely secret.

Thanks to our completely hosed corporate tax system, companies like Goldman can ship their revenues offshore and defer taxes on those revenues indefinitely, even while they claim deductions upfront on that same untaxed income. This is why any corporation with an at least occasionally sober accountant can usually find a way to zero out its taxes. A GAO report, in fact, found that between 1998 and 2005, roughly two-thirds of all corporations operating in the U.S. paid no taxes at all.

"With the right hand out begging for bailout money," he said, "the left is hiding it offshore."

CRISIS-BUBBLE #5 - The Health care crisis.

MANY OF THE PLAYERS PREVIOUSLY MENTIONED ARE AT PRESENT STILL INSIDE THE GOVERNMENT.

Robert Rubin, fought to overturn the Glass-Steagal act. opposed regulation of credit swaps helped create Citigroup out of which he made $115 million still on City group, the mentor of Timothy Geithner (in actuality in president’s Obama cabinet).

Christopher Cox chairman of the SEC 2005-2009 Gave the market a free ride waiting until too late to reverse the voluntary regulation program of 2004, thus favoring the catastrophe.

Henry Paulson CEO of Goldman 1999-2006, Treasury secretary 2007. He arranged the bailout for Goldman and made his decisions non-reviewable. F0RMER CEO OF GOLDMAN WHO PLACED ED LIDDY FORMER GOLDMAN EXECUTIVE IN CHARGE OF BAILING OUT AIG IN THE AMOUNT OF AND WHO ALSO GAVE GOLDMAN 13 BILLION AS LIDDY CAME ON BOARD.

ALL OF THE PREVIOUS CRISIS BUBBLES HAVE RESULTED IN CREATING A HIGHLY SOPHISTICATED ENGINE THAT CONVERTS THE USEFUL DEPLOYED WEALTH OF SOCIETY TO THE LEAST USEFUL, MOST WASTEFUL AND INSOLUBLE SUBSTANCE PURE PROFIT FOR THE SAME RICH THAT MANAGE NOW HMO AND DRUG COMPANIES.

Here is a comparison of the United States' health care costs versus those of selected other countries in 2006:

UNITED STATES: 15.9 pct of GDP, $6,657 per capita

BRAZIL: 7.9 pct of GDP, $371 per capita

CANADA: 9.7 pct of GDP, $3,430 per capita

CHINA: 4.7 pct of GDP, $81 per capita

FRANCE: 11.1 pct of GDP, $3,807 per capita

GERMANY: 10.7 pct of GDP, $3,628 per capita

INDIA: 5.0 pct of GDP, $36 per capita

ISRAEL: 7.9 pct of GDP, $1,533 per capita

JAPAN: 8.2 pct of GDP, $2,936 per capita

MEXICO: 6.4 pct of GDP, $474 per capita

SOUTH AFRICA: 8.7 pct of GDP, $437 per capita

SWEDEN: 8.9 pct of GDP, $3,598 per capita

RUSSIAN FEDERATION: 5.2 pct of GDP, $277 per capita

UNITED KINGDOM: 8.2 pct of GDP, $3,064 per capita

(Source: The World Bank)

In this world some of us have to play by the rules while others apparently do not. Not only are they excused from their work, they also receive free dollars in non-traceable paper bags.

LEGAL PROTECTION

Doctors are ordering tests to protect their behinds because of the malpractice climate. Most agree. However, in order to solve this problem we must have relief against medical tort. Nowhere do we see this even being considered in the health care reform plan.

MEDICAL MALPRACTICE FACTS

Medical diagnostic, procedural and treatment of patients are a complex biological and technical service where each individual is a different case, even if having the same condition as other. Of course, errors can occur.

Victims of injuries can never be properly compensated for said errors.

A pretense that they can be compensated has been created through litigation that becomes a horrifying experience trying to place value on human life, adding, multiplying, subtracting, dividing, and extrapolating hypothetical expectations, when in reality they are based on available money to be paid to the plaintiff and its lawyer.

There are more than 125,000 frivolous, meritless cases in progress every day at a cost of a minimum of $30,000 each.

The cost of tort has risen by a factor of 400 between 1940 and 1990. Typical payouts average: 24% for economic cost to the victim; 22% for pain and suffering; 24% for administration of the case, 16% for claimant's attorneys' fees; and 14% for other defense costs.

The cost of medical defense is between $50 to $90 billion each year.

The only result has been the closure of clinics, the driving away of physicians from their practices and the jeopardizing of patient proper care, while driving up costs. One third of the cost of a pacemaker or a third of the cost of a simple tonsillectomy goes to liability protection. In Nevada, women have to deliver babies in the Emergency Room or go to another State, because the OB/GYN liability policies have scared away specialists.

A recent fanfare over medical practice is in essence a well thought plan to deviate attention from the real problems stated above and for all practical reasons create a "medical malpractice hoax."

THE COST OF A LIFE

Caps on non-economic damages in all Florida court cases involving injury or death due to medical negligence is $500,000 –regardless of the number of defendants – in suits against health care practioner defendants (physicians and surgeons) and $750,000 per claimant in suits against non-practioner defendants (hospitals and other non-physicians).

The court can decide to exceed these caps in certain circumstances. In cases of catastrophic injury or negligence that results in a permanent vegetative state or death, a patient may recover up to $1 million and $1.5 million, respectively.

For any type of injury resulting from emergency care, the law caps non-economic damages at $100,000 per claimant, but not to exceed $300,000 for all claimants, in suits against practioner defendants and $750,000 per claimant, but not to exceed $1.5 million for all claimants, in suits against non-practioner defendants.

Tort reform helps protect qualified doctors from exorbitant judgments and may drive them out of state, and even out of practice. Losing good doctors simply does not benefit anyone.

FINAL CONCLUSIONS

What is happening with health care?

Going back to October 2, 1942, a vote was placed on the so-called “stabilization act” of 1942. This bill allowed employers to deduct from taxable income all payments for employee health premiums.

But it did not allow the same benefit if the employee paid. It was at this moment that the workers lost management of their family’s health care and the employer without a day of training became their doctor.

April 10, 1965 LBJ signed into law a bill to provide healthcare benefits for anyone who had passed his or her 65th birthday.

Medicare was created. On this day the federal government without schooling awarded itself an MD degree. As a result of these two issues, individual patients lost control over their medical care and all control over the costs.

Today healthcare is enormously expensive, more so than in any nation. In total $2.2 Trillion a year. Many doctors have abandoned their computerized record systems; and only 20% of doctors actually use such programs.

Patients complain that the physician is treating not them but the computer, since eye contact has evaporated. Shrinking compensation has provoked either early retirement or doubling the daily patient load, necessarily resulting in a halving of doctor-patient interaction time. Return phone calls are an anachronism.

Indeed, as a result of key legislative errors, $2 Trillion dollars are being pumped into US healthcare every year without the supervision of the people who earned it, temporarily owned it, and should have controlled it. Our healthcare is getting more expensive and less accessible.

PPOs and HMOs and physician-insurance company contracts began the amateur rationing phase. In fact, the doctor had to promise the payer that he would accept whatever they paid.

The health insurance cartel devised multiple rationing methods such as: precertification, denial of benefits, increase of uncovered procedures and other strict measures such as “inadequate documentation.” The health plans had taken a heart and ate the government.

MONEY LAUNDERING $2.2 Trillion had to be laundered through the system each year. This had to be done before the patient or the doctor received any kind of compensation

The politicians, such as Hillary Clinton, going back to the 1990s, made speeches stating that the patients should choose their own doctor, doctors should run health care, insurance companies should not be telling doctors what to do. They problem was that her 1400 page proposal was offering precisely the reverse

POLICY MAKING: The policy scholars assigned to observe and design the new changes have always been spectators from their seats in a stadium. They have never been on the floor of the arena where the gladiators are. Round tables on health care issues, for example, contained among its 20 members, one practicing physician, and no documented patients.

“The commonwealth fund,” contains 19 members, of which some are MDs, some PhDs -but none of the MDs are treating physicians.

The bipartisan committee of the future of healthcare

What about other systems in other countries? A report from the CATO institute tells us “the grass is not always greener.” Unified health systems of 12 developed countries were studied concluding that 1. They are all different 2. Not that universal and 3. Not that wonderful.

There are 60 million people, in a 300 million population, without health insurance coverage.

Doctors are bound by law to do the right thing for patients, to protect them and inform them of choices, alternatives and risks. But they do not participate in decision making regarding healthcare

Meanwhile, profit seeking managed care continues to make multimillionaires of venture investors, by compromising proper care, leaving doctors with moral, legal and financial residuals.

Improper care is created by the displacement of drug coverage, non-coverage of medically necessary items, and delayed referral to overworked specialists, as the tools for "rationing" due care.

All of the issues presented in this article are to be carefully considered if any kind of health care reform is to be effective.

Interesting data one should familiarize themselves with in the new world in order to able to interpret expenditures nowadays.

1,000 X 1 thousand = 1 million (106)

1,000 X 1 million = 1 billion (109)

1,000 X 1 billion = 1 trillion (1012)

1,000 X 1 trillion = 1 quadrillion (1015)

1,000 X 1 quadrillion = 1 quintillion (1018)

1,000 X 1 quintillion = 1 sextillion (1021)

1,000 X 1 sextillion = 1 septillion (1024)

1,000 X 1 septillion = 1 octillion (1027)

1,000 X 1 octillion = 1 nonillion (1030)

1,000 X 1 nonillion = 1 decillion (1033)

1,000 X 1 decillion = 1 unodecillion (1036)

1,000 X 1 unodecillion = 1 duodecillion (1039)

Other very large numbers are:

One googol = 10100

One googolplex = 10googol

One googolplexian = 10googolplex

Even larger numbers exist. One is called "Graham's Number", which is so large that it could never be written out using ordinary number notations.

For further reading, please see the editorial Health Care Reform and You as it appeared in the NY Times.

http://www.nytimes.com/2009/07/26/opinion/26sun1.html